Direct Tax

Language Hindi – English Mix.

No of lectures 80-85 Lectures Approx.

Duration 240-250 hours Approx.

Validity 1 Year from the date of Activation.

Views 1.5 Times.

Study Material Bare Act Provision Book / Compact 4.0 / Q & A Compiler.

Indirect Tax

No of lectures 42 Lectures Approx.

Duration 125 Hours Approx.

Validity 12 Months from the date of Activation.

Views 1.5 Times.

Study Material Custom Law | GST VOL. 1,2 AND 3 Regular | Descriptive Question Answer Book | MCQ’S Four Charts | Four Wall Charts

Audit

Duration 150 Hours Approx.

No. of Lectures 60 Lectures.

Validity 2 Years from the date of Activation.

View 1.7 Times.

Study Material Hardcopy of Coloured Notes & Question Bank Including MCQ’s.

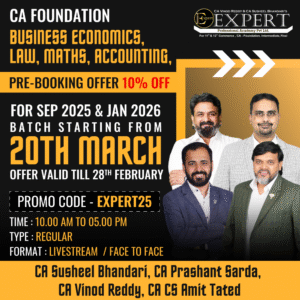

CA Shubham Keswani

CA Shubham Keswani is a Merit holder at CA Final & Inter level. He completed his 3 years of Articleship training in the field of Audit & Assurance from EY. Having secured exemption in Auditing at both levels of his CA Journey, his purpose is to enlighten you with his experience & expertise.

CA Bhanwar Borana

Founder of BB Virtuals, CA Bhanwar Borana has given 500+ ranks in CA and gives regular lectures at ICAI and various taxation platforms with 12 years of teaching experience in IPCC and Final Direct and International Taxation exams.

CA Raj Kumar

A renowned Indirect Tax expert with 16+ years of teaching, has mentored 1,65,000+ students, producing multiple AIR #1s. Known for his practical approach, GST portal integration, and bestselling GST Compact Book, he also trains IRS officers.

Cancellation/ Refund Policy

* Course once purchased cannot be cancelled & fees are non-refundable.

* Subscribed Courses cannot be changed with another course.

* The course is non-transferable.