Language Hindi – English Mix

Audit

Duration 150 Hours

Validity 1 Year from the Date of Activation

View 1.7 View

Study Material Notes & Question Bank hardcopy

Adv. Accountng

Duration 230 hours Approx.

Validity 1 Year from the date of Activation.

Views 1.7 Views

Study Material 2 Q&A Book

Direct Tax

Duration 175 Hours

Views 1.5 Times

Validty 1 Year from the date of activation

Study Material 1 Compact Theory Book

CA Shubham Keswani

CA Shubham Keswani is a Merit holder at CA Final & Inter level. He completed his 3 years of Articleship training in the field of Audit & Assurance from EY. Having secured exemption in Auditing at both levels of his CA Journey, his purpose is to enlighten you with his experience & expertise.

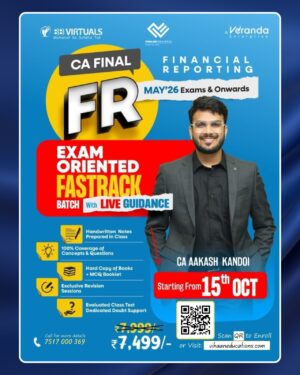

CA Aakash Kandoi

CA Aakash Kandoi is a qualified professional with CA, Dip IFS (ACCA, UK). He is a passionate professor with more than four years of teaching experience in the CA Foundation, CA Inter, and CA Final levels. He has expertise in conceptual teaching and strives to bring out the best of knowledge in his students. His zeal for education is based on his quote “Application of knowledge is more important than having it” which shows his focus on applying knowledge in order to achieve the desired results.

CA Bhanwar Borana

Founder of BB Virtuals, CA Bhanwar Borana is one of India’s most trusted educators in Direct and International Taxation. With 14+ years of teaching experience, he has guided thousands of students, producing 800+ All India Rank holders. A regular speaker at ICAI and various taxation platforms, he is known for his dynamic teaching style and deep subject expertise, passionately mentoring future CAs to achieve both academic excellence and practical insights for a successful career.

Cancellation/ Refund Policy

* Course once purchased cannot be canceled & fees are non-refundable.

* Subscribed Courses cannot be changed with another course.

* The course is non-transferable.